Hi, this is Beth Harrington. Welcome to our question of the week. Our question of the week is very timely. It's about 5,500 filings for qualified plans. Qualified plans don't have taxes, but they do have a tax return that's required every year. Calendar year plans have their tax return due on July thirty-first. Tax returns for qualified plans are called a form 5500, and there are a few different variations of the 5500. If you're a very small company with just you, maybe your spouse or maybe one partner, we have an easy filing called 5500 Easy. These are due on July thirty-first for calendar year filers. If you're a corporate plan or a partnership, or any plan that has employees, usually you have a 5500 STF (Short Form). You can file the SF as long as you don't have any employer stock or unusual assets in your plan, and as long as you have fewer than 100 employees in your plan. If you have employer stock or unusual assets, or more than 100 employees, then you're required to file a full form 5500. If you have more than 100 employees, you are also required to have a CPA audit form attached to your 5500, and that's a separate filing. We can't do the audits for you as we are not CPAs here at Benefit Resources. In general, 5500s are due seven months after the end of the plan year. We can file for an extension if you need more time, for another two and a half months. So, for calendar year plans, that means October 15th is the drop-dead due date. If, for whatever reason, you find that you missed a due date or you didn't have a filing extension, then we can request a delinquent filer. The...

Award-winning PDF software

What is the due date for filing 5500 Form: What You Should Know

In all other situations. Form 5500 Forms — The Latest July 31, 2024 — Notice that all employees in 2024 were given a Form 5500 extension. If you are a 2024 Form 5500 or have questions as to the amount of the extension, you should contact your plan administrator. April 22, 2024 — Form 5500 Due Dates for 2017 Apr 22, 2024 — If you are the beneficiary in 2024 and were provided with a Form 5500 because of a concurrent filing, you should file your annual Form 5500 by June 28th. You should not file Form 5500 until July 31st. Apr 20, 2024 — Form 5500 Form for 2017 You will need to file Form 5500 as part of your annual income tax return and be filed no later than April 26th. If your plan is in compliance with the applicable income tax laws, no Form 5500 is due or your plan has become taxable, and you need to file Form 5500, please consult a tax professional in the state where you expect to file Form 5500. For more information on Form 5500, please contact your local IRS office. Form 5500: 2024 and 2017 Form 5500: 2024 (updated Oct 24, 2017) Form 5500: 2024 (updated Nov 17, 2017) Form 5500: 2024 (updated Nov 17, 2016) Form 5500: 2024 (updated Feb 28, 2015) Form 5500: 2024 (updated Nov 17, 2014) Form 5500: 2024 (updated Nov 17, 2013) The IRS recently released a summary of 2024 and 2024 Form 5500 filings. The summary also details how the IRS received 2024 and 2024 Form 5500 filers. Form 5 For 2024 Form 5500 applications submitted and accepted in calendar year 2019, we are requiring that all applications be approved as of December 31, 2016. This delay of processing will not affect 2024 plans that must be filed after June 22, 2016. Any applications submitted in 2024 by June 30, 2016, must be approved as of December 31, 2016. See IRS Notice 2016-17 for more information.

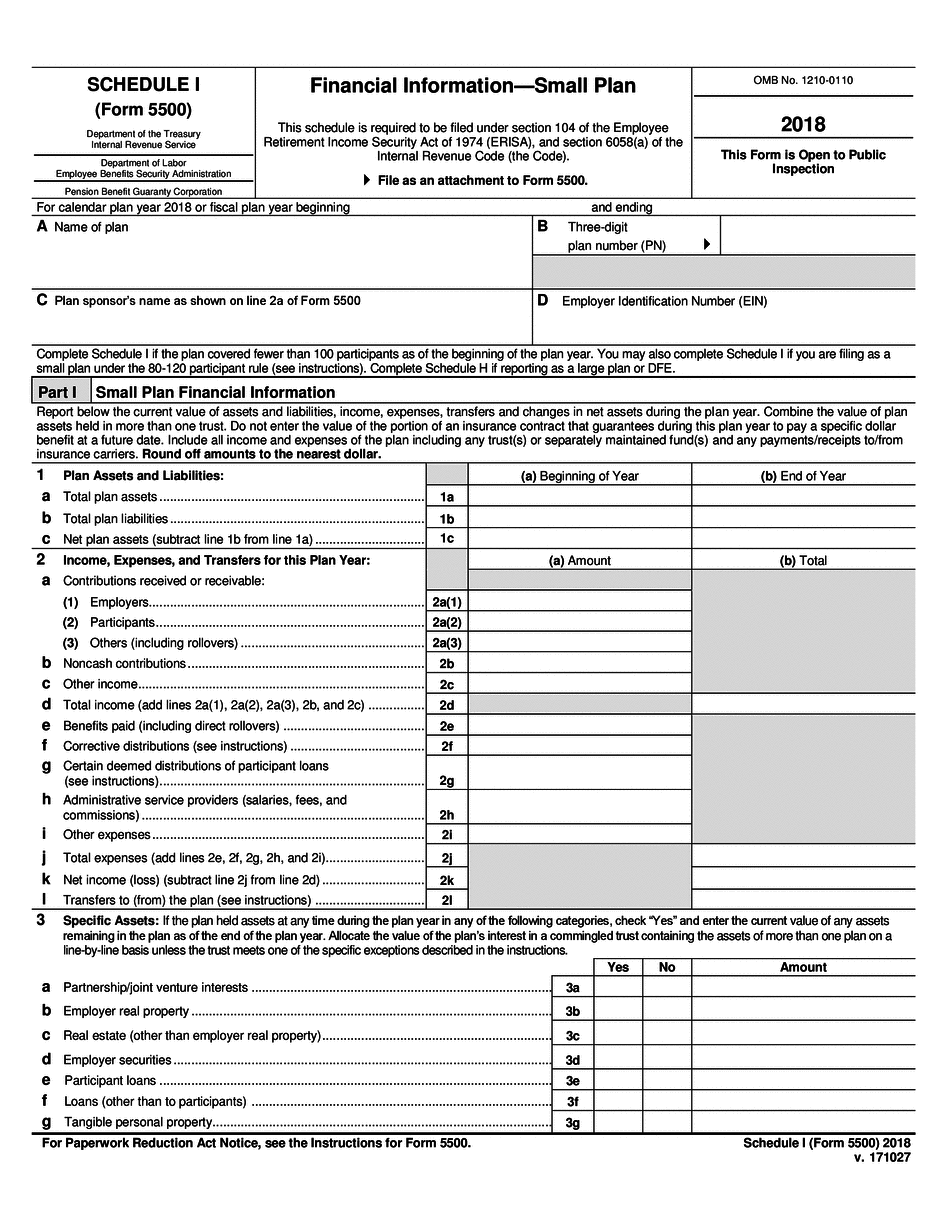

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5500 - Schedule I, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5500 - Schedule I online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5500 - Schedule I by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5500 - Schedule I from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing What is the due date for filing Form 5500